InSapphoWeTrust.

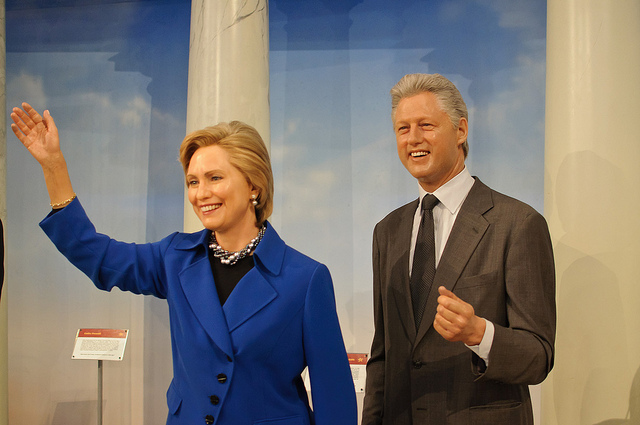

Many of the characteristics of Hillary Clinton’s campaign, such as pragmatism, caution, and exacting preparation, are also associated with the way she, and her husband and ex-president Bill Clinton, have handled their estate planning.

Through the creation of insurance and property trusts the Clintons have been able to utilize tax strategies that will shield a generous percentage of their assets from estate taxes. Today the tax goes into effect on estates whose value is over $5.45 million per individual, or $10.9 per couple. Above that amount the tax starts at 18%, but quickly rises to 40%.

What is ironic is that Clinton has proposed to reform the tax code. She has suggested making the threshold for estate taxes lower, down to $3.5 million per person, and to change the top rate to 45%. If those rules go into effect, the Clintons would be hit with a larger estate tax bill after their demise.

One of the strategies the Clintons have used to reign in their estate tax bill is through residence trusts. These trusts prevent any growth in the value of the property from being counted in the couple’s estate, and therefore from being taxed at the higher value of the property. This can result in considerable tax savings for their heirs.

The Clintons have two such residence trusts. In 2011 they shifted ownership of their home in Chappaqua, NY into those trusts, thus locking in the value of the home at 2011 levels. The more the value of their home grows, the more money they will save in estate taxes, says estate planning and taxation expert Jonathan Blattmachr. There is a potential for them to save hundreds of thousands of dollars in taxes.

The property was purchased by the Clintons in 1999 for $1.7 million, and last year was valued at $2.3 million (four years after the property was moved into the trust.) The IRS assumes the home is worth less than its true market value, because the heirs won’t own it for several years, usually between 10 and 15 years. But the length of a residence trust can vary a lot.

“The longer the term, the smaller the [value of the] gift,” says Jonathan Blattmachr, who is a co-author of Bloomberg BNA’s tax management book on personal residence trusts.

There is a catch, Blattmachr warns: If you make the term of the trust too long, and you die before the trust expires, the property moves back into your taxable estate. Any increase in value of the property will count against your estate tax exemption.

The Clintons own another home in Washington, DC. Valued at about $5.76 million, the couple have not put this home into a trust. Blattmachr says there are several possible reasons for this. For one thing, the Clintons might not have much hope that the property’s value will increase. It is also more complicated to sell a home that is inside a trust, and the Clintons might want to sell at some point.